The stock market is often described as a place where fortunes are made and lost. However, behind many of these success stories lies a powerful financial principle: compounding. Compounding, often referred to as the “eighth wonder of the world,” has the potential to turn small, consistent investments into significant wealth over time. For Indian investors, understanding and leveraging the power of compounding can pave the way to long-term financial freedom.

The stock market is often described as a place where fortunes are made and lost. However, behind many of these success stories lies a powerful financial principle: compounding. Compounding, often referred to as the “eighth wonder of the world,” has the potential to turn small, consistent investments into significant wealth over time. For Indian investors, understanding and leveraging the power of compounding can pave the way to long-term financial freedom.

In this blog, we’ll explore the concept of compounding, its importance in the stock market, how to harness it effectively, and real-life examples of investors who have used it to their advantage.

What is Compounding?

Compounding is the process where your investments generate earnings, and those earnings, in turn, generate more earnings. This creates a snowball effect, where your money grows at an accelerating pace over time.

The formula for compounding is:

A = P (1 + r/n)^(nt)

Where:

A = Future Value of the investment

P = Principal amount (initial investment)

r = Annual interest rate (in decimal)

n = Number of times interest is compounded per year

t = Time in years

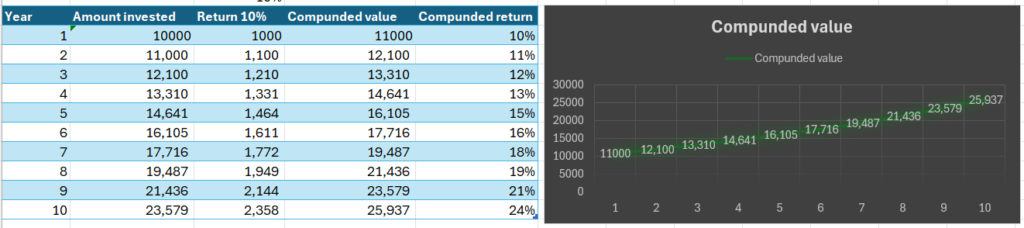

For example: To make it easy understood, I put a simple example in which you have invested 10,000 Rs. In the beginning of first year & you kept your amount invested for 10 years at an annual rate or return of 10%, by the end of 10th year you got a compounded return of 24%.

While the formula may seem complex, the underlying principle is simple: the longer you stay invested, the more your money grows.

The Power of Compounding in Action

Illustration

Let’s say you invest ₹1,00,000 in the stock market at an annual return of 12% (a reasonable expectation in the Indian equity market).

- After 10 years: ₹3,10,584

- After 20 years: ₹9,64,630

- After 30 years: ₹30,00,000+

Notice how the growth accelerates in the later years. This is the magic of compounding—the longer you stay invested, the greater your returns.

The Role of Time: Start Early, Grow Big

The key to maximizing the benefits of compounding is time. The earlier you start investing, the more time your money has to grow. Let’s compare two scenarios:

- Investor A starts investing ₹10,000 per month at age 25 and continues until age 35 (10 years). He stops contributing but lets the investment grow.

- Investor B starts investing ₹10,000 per month at age 35 and continues until age 55 (20 years).

Assuming an annual return of 12%:

- Investor A’s corpus at 55: ₹1.54 crore

- Investor B’s corpus at 55: ₹1.28 crore

Even though Investor B invested for twice as long, Investor A’s early start gave his money more time to compound, resulting in a larger corpus.

Compounding in the Indian Stock Market

The Indian stock market, with indices like the Nifty 50 and Sensex, has historically delivered impressive returns over the long term. Despite short-term volatility, the market’s upward trajectory makes it an ideal avenue for harnessing the power of compounding.

Historical Performance of Indian Indices

- The Sensex, which was at 100 in 1979, crossed 60,000 in 2023. This represents a compounded annual growth rate (CAGR) of approximately 15% over four decades.

- Companies like HDFC Bank, Infosys, and Reliance Industries have delivered multi-fold returns for long-term investors, showcasing the power of staying invested.

Example: Infosys

- If you had invested ₹1 lakh in Infosys during its IPO in 1993, your investment would be worth over ₹200 crore today. This staggering growth is a testament to the power of compounding combined with the growth of a fundamentally strong company.

Strategies to Harness the Power of Compounding

- Invest for the Long Term

Compounding requires time to work its magic. Avoid the temptation to chase quick profits or time the market. Instead, focus on staying invested for the long haul.

- Reinvest Your Returns

Whether it’s dividends from stocks or interest from bonds, reinvesting these earnings accelerates the compounding effect.

- Invest Regularly

Systematic Investment Plans (SIPs) allow you to invest a fixed amount regularly in mutual funds. SIPs not only leverage compounding but also benefit from rupee cost averaging, reducing the impact of market volatility.

- Choose Growth-Oriented Assets

Equities and equity mutual funds offer the highest potential for compounding due to their superior long-term returns compared to fixed-income instruments.

- Minimize Expenses

High fees and taxes can erode your returns, reducing the compounding effect. Opt for low-cost funds and utilize tax-saving instruments like ELSS (Equity-Linked Savings Scheme).

Challenges to Compounding in the Stock Market

- Market Volatility

The Indian stock market is prone to fluctuations due to global and domestic factors. Emotional reactions to short-term losses can lead investors to exit prematurely, disrupting the compounding process.

- Inflation

High inflation can diminish the real value of returns. Equities, however, have historically outpaced inflation, making them a preferred choice for long-term compounding.

- Lack of Discipline

Irregular investments or withdrawing funds early can hinder the compounding effect. Staying disciplined and patient is crucial.

Lessons from Legendary Investors

Warren Buffett

Often referred to as the “Oracle of Omaha,” Warren Buffett is a living example of the power of compounding. He started investing at age 11 and amassed most of his wealth after the age of 50. His investment philosophy revolves around buying quality businesses and holding them for the long term.

Rakesh Jhunjhunwala

India’s very own “Big Bull,” the late Rakesh Jhunjhunwala, turned an initial investment of ₹5,000 into billions by leveraging compounding and identifying multi-bagger stocks like Titan and Lupin.

Charlie Munger

Buffett’s partner, Charlie Munger, emphasizes patience and long-term thinking, stating, “The first rule of compounding is to never interrupt it unnecessarily.”

Tools to Leverage Compounding in India

- Mutual Funds

- Equity Mutual Funds: Ideal for long-term growth.

- SIP: Automates regular investments, making it easier to stay consistent.

- Direct Equity

Investing in quality stocks with strong fundamentals ensures better compounding over time. Focus on sectors like technology, banking, and consumption.

- Index Funds and ETFs

Low-cost index funds and ETFs track indices like the Nifty 50, providing diversified exposure and steady compounding.

- Tax-Advantaged Accounts

Utilize accounts like PPF (Public Provident Fund) and NPS (National Pension System) for tax-efficient compounding.

Real-Life Case Study

The Power of SIP in Indian Context

- Investor: Rajesh starts a SIP of ₹10,000 per month in an equity mutual fund delivering a 12% annual return.

- Duration: 20 years

After 20 years, Rajesh’s total investment is ₹24 lakh, but the corpus grows to over ₹71 lakh due to compounding.

Common Misconceptions About Compounding

- It’s Only for the Rich

Even small investments grow significantly over time. The key is consistency and patience.

- High Returns Are Essential

While higher returns accelerate growth, even modest returns can compound impressively over decades.

- It Works Only in Bull Markets

Compounding works in all market conditions, as long as you stay invested and reinvest your earnings.

Conclusion

The power of compounding is a time-tested principle that can transform your financial future. For Indian investors, the rapidly growing stock market provides ample opportunities to harness this principle. Whether you’re investing in blue-chip stocks, mutual funds, or index funds, the key is to start early, stay consistent, and remain patient.

As legendary investor Warren Buffett once said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” Start planting your financial tree today and watch compounding work its magic in the years to come.